What Retail Banking Can Learn from Thomas Cook’s Demise

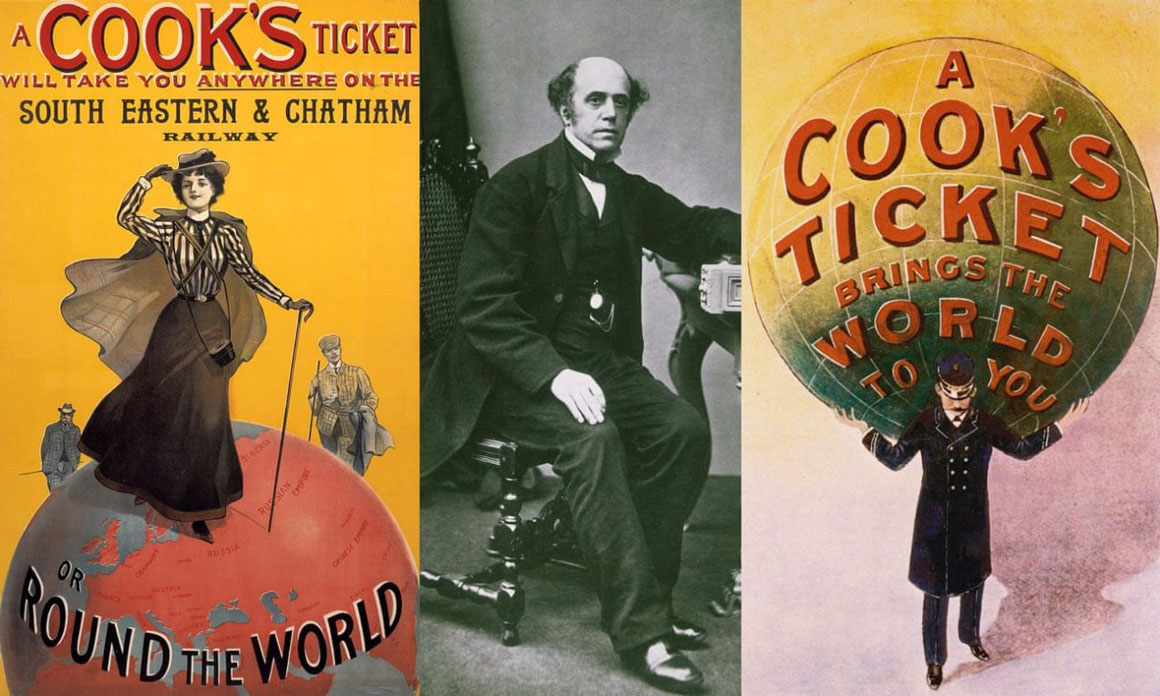

The news over the weekend of the venerated consumer brand that had been operating for over 178 years abruptly going bankrupt really caught our attention. The headlines blamed high debt load, a disastrous merger, and the one-two punch of bad weather and Brexit for the failure of the world’s oldest travel company. But a deeper examination of the facts in this case lead to the true culprit: the Internet did it.

As a retailer, Thomas Cook had an enviable network: over 560 branches on the high street, where customers could review product brochures, get advice from knowledgeable advisors, and select the solution that was just right for them. The firm’s 2018 annual report, while acknowledging the challenges of transitioning the company to be more digitally focused, was full of the right messaging: millennials on the front cover, a promise that the brand was “accessible however they choose to interact with us”, and a full-page case study on the company’s new mobile app.

Given that, and all of the copy about Net Promoter Scores, progress towards become a truly omni-channel business, and the use of advanced algorithms and machine learning, you’d be forgiven if you didn’t know that their branch customers were mostly over 65.

Gradually, the company’s business was eroded by mono-line competitors (Ryanair, easyJet), digital pure-plays (Airbnb), an inability to attract digital natives, and an aging customer base. Suddenly, less than ten months after a November 28, 2018 letter to shareholders in which their Chairman wrote, “the Board is confident the strategy…the team has been pursuing is the right one”, Thomas Cook collapsed.

Many other established companies were similarly encumbered by an unfavorable political and regulatory environment, and just like Thomas Cook were likely burdened with “still too many legacy systems and processes” impeding their transformation. Yet, they did the one thing that Thomas Cook did not do: move quickly to embrace a digital future