“ZMOT” and Financial Services

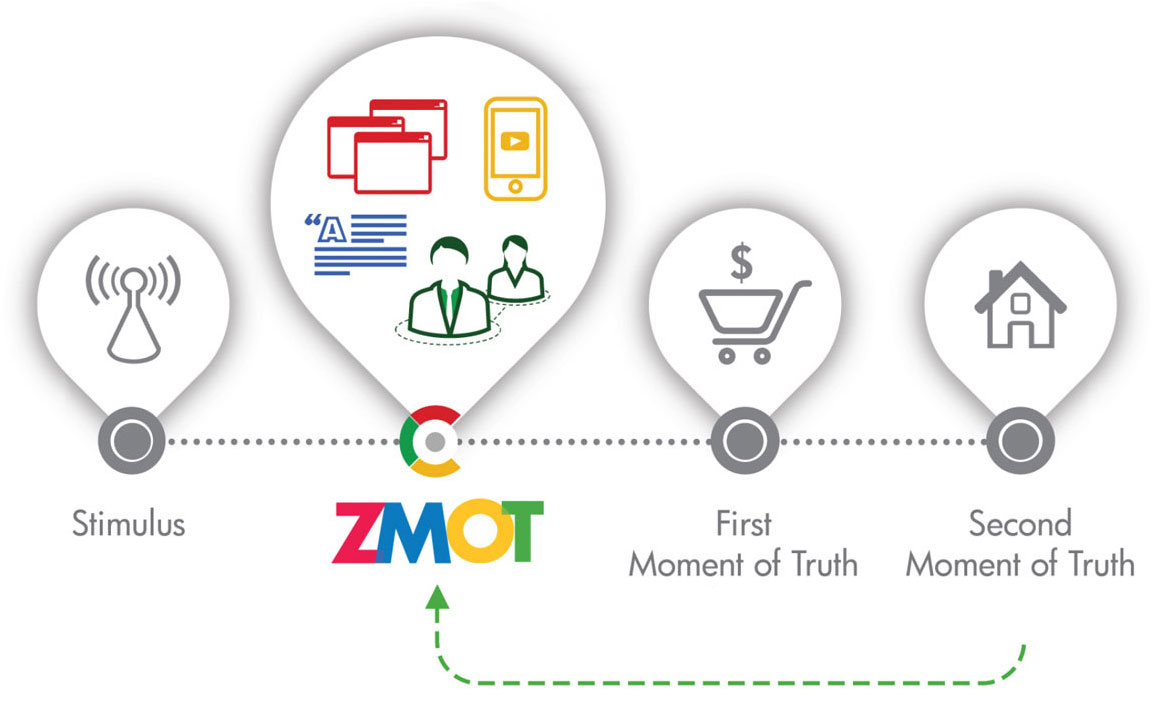

In 2011, Google introduced Zero Moment of Truth, or ZMOT, which described, “a revolution in the way consumers search for information online and make decisions about brands.” Google argued for being present at the exact moment a consumer had a need to fulfill. The approach seemed to follow Woody Allen’s advice: “showing up is 80% of life.” Of course, because Google was being paid for making sure your brand “showed up” 100% of the time (or more!), many marketers took the advice with a grain of salt.

Earlier this year, a column in Adweek called ZMOT – and the new term micro-moment marketing – as one of the top trends to watch. The author observed that, because mobile devices are now truly ubiquitous and the shift in consumer buying behavior initially forecasted in 2011 had become the new normal, ZMOT’s time had finally arrived.

In addition to arguing for showing up, today’s micro-moment marketing techniques eschew last-click and last-touch attribution in customer acquisition. The modern approach considers the importance of understanding the full customer journey, from answering early stage questions to deep product investigation and finally, conversion.

In financial services, this means assessing the impact of digital, contact center, and branch, and assigning attribution appropriately – regardless of where an account is finally opened.

This evolved view of ZMOT now gives us a compelling framework for understanding the cross-channel journey that consumers undertake as they evaluate a new financial services product.